Can Prop Trading Be Sustainable as a Long-Term Career?

The answer is yes; every trader, when they enter the prop trading landscape, desires a long-term career. Prop trading firms give them opportunities to achieve sustainable success and growth. If you are a novice trader and want long-term financial returns, but are uncertain about whether joining a prop firm can be a sustainable option for you, look nowhere else. In this detailed guide, you will discover five key factors contributing to sustainable career growth in the trading realm and what challenges, when navigated, can benefit you.

Factors Contributing to a Sustainable Trading Career

First of all, look at some essential things traders, including you, must consider to achieve a long-term yet successful prop trading career.

Continuous Learning and Skill Development – With changes in financial markets, ongoing learning and education are mandatory. Traders are obliged to stay informed about various aspects, such as new technologies, market trends, and trading strategies. Additionally, most prop firms offer opportunities to learn and develop trading skills and plans, contributing to making their trading experiences more lucrative.

Strong Risk Management – Another key contributor is the implementation of effective risk management strategies, such as the 1-2% rule. Assessing your risk tolerance and avoiding overtrading will lead to long-term success and capital preservation. While working with a prop firm like Maven Trading, you can seek guidance on mitigating risks and maximizing potential returns, assisting you to stay on the right track.

Emotional Discipline – The trading journey is full of emotions. Celebrating successes and feeling bad over losses or failures are common. Beyond that, feelings of fear and greed can result in impulsive trades, leading to failures and a weakened reputation in the trading firm. Maintaining emotional control under pressure is vital for making rational decisions.

Adaptability – Markets, tech advancements, and regulations continue to evolve over time. The ability to adapt to changes is crucial for long-term sustainability. New trading and risk management rules are set by prop trading firms that traders must stick to stay ahead of the curve.

Choosing the Right Firm – Higher earnings and wins heavily depend on how reliable the prop firm is with which you are working. That’s why it’s necessary to ensure that a prop firm best aligns with your trading style. Access to adequate resources and a supportive environment is what can enhance your overall trading experience.

Challenges You Should Consider

Every prop trader goes through a series of challenges, some of which are as follows:

Performance Pressure – Unlike independent trading, prop trading can be highly competitive. That’s where the pressure to perform well can be intense.

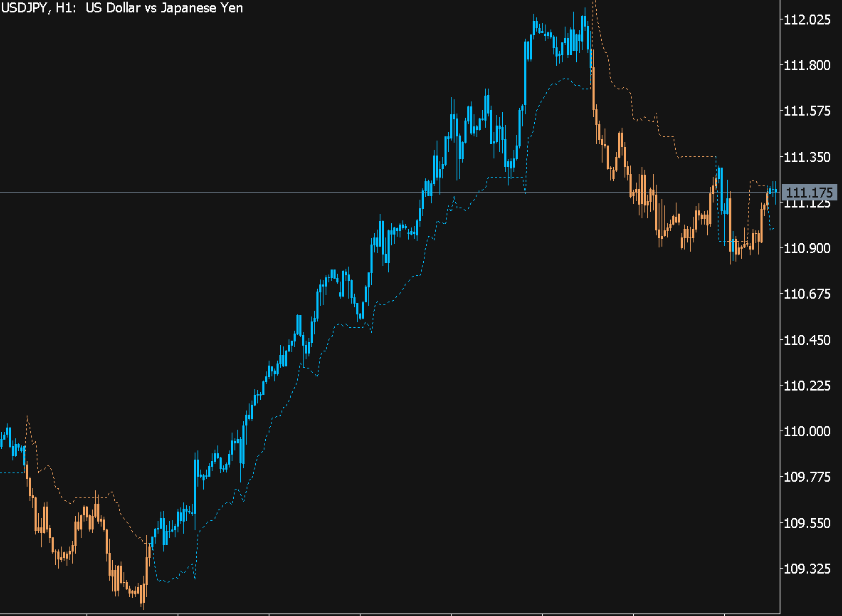

Market Volatility – As stated earlier, financial markets continue to fluctuate. If traders don’t adapt their trading plans and strategies according to changes, they will experience hard-to-recover losses.

Technological Advancements – Keeping up with technological advancements and integrating them into trading strategies requires continuous effort. If not made, lots of stress and trading failures come your way.

Conclusion

In the prop trading landscape, sustainable success comes with consistency, the right strategies, market research, and dedication toward achieving long-term goals. So, what are you still waiting for? Ready to embark on the prop trading journey with higher prospects of financial rewards and a successful career ahead.