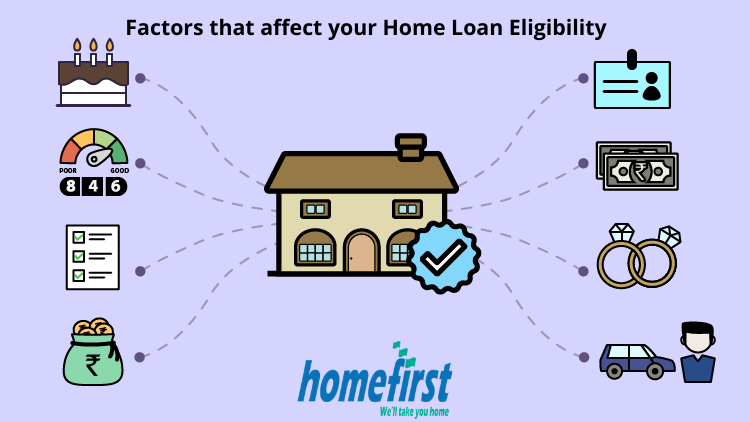

Factors influencing eligibility for a home loan in the UAE

Protecting home loans in the United Arab Emirates is an essential financial undertaking that includes evaluating diverse factors. Economic organizations in the United Arab Emirates touch stringent criteria to find people eligible for home loans. Knowing the factors is essential for homeowners looking for financing in Dubai.

Stability Of Income

One of the primary considerations for home loan eligibility in the United Arab Emirates is the borrower’s income. Lenders need a constant and daily source of income. People with persistent job records and higher income levels are considered lower-risk borrowers. Banks scrutinize the constancy of the job, examining the duration of employment and the likelihood of continual job protection.Mortgage broker UAE support the people in the entire steps.

Debt-to-Income Ratio

Lenders examine people’s debt-to-income ratio to examine the ability to arrange more debt. DTI is calculated by dividing the monthly debt payment by the gross monthly income. Less DTI gives a healthier financial status and improves the home loan eligibility level.

Credit Record

Boosting the credit record is essential for protecting a home loan. Lenders examine the applicant’s credit score, which reflects his credit rating based on previous financial behavior. Higher credit scores improve loan approval likelihood and may result in a suitable interest rate. Debts, late payments, and defaults can adversely affect the credit score and eligibility for the home loan.

Down Payments

The down payment amount is an essential determinant of loan eligibility. Banks in Dubai need the borrowers to give a percentage of the value of the assets the down payment. More payment displays the borrower’s financial discipline and less risk for the lender. Some financial organizations provide suitable loan terms for borrowers who can provide a more significant down payment.

PropertyAssessment

Property value being financed is the main factor. Lenders conduct their assets’ valuation independently to ensure loan amounts connect with market value. If the loan is valued high, influence the approval in less favorable conditions.

Tenure Framework And Bank Relations

Borrowers’ age can influence eligibility as banks focus on the people’s ability to repay the loan during working years. The loan term is also an essential factor with shorter, way to lower interest rates but high monthly payments. Relationships with the lending organization can be beneficial. People with a record of banks, like repayment on time of past loans and best-saving accounts, may get the treatment in loan approval.

Market Terms

Home finance in UAE pool conditions can also impact eligibility. During periods of economic uncertainty, banks are more conservative in their borrowing policies, making it essential for the borrower to be aware of the predominant terms.

Conclusion

Protecting a home loan in the United Arab Emirates includes examining different financial and personal reasons. Homeowners must be careful of their economic standing, credit record, and the particular needs of lending organizations to improve liability and protect suitable loan conditions. It is possible to examine expert suggestions and research the options accessible in the UAE’s real estate market.